Contact

Home Knowledge Base

Differences between IND AS 19 vs AS 15(R)

The new accounting standards IND AS 19 introduced by the Ministry of Corporate Affairs and is now being followed in reporting financials has the following key changes when compared with AS – 15(R). It is noted that IND AS 19 is modelled closely on IAS 19 accounting standards that is being used globally. Thus, IND AS 19 brings conformity of accounting standards followed by Indian companies with that of International companies.

Concept of OCI - Other Comprehensive Income

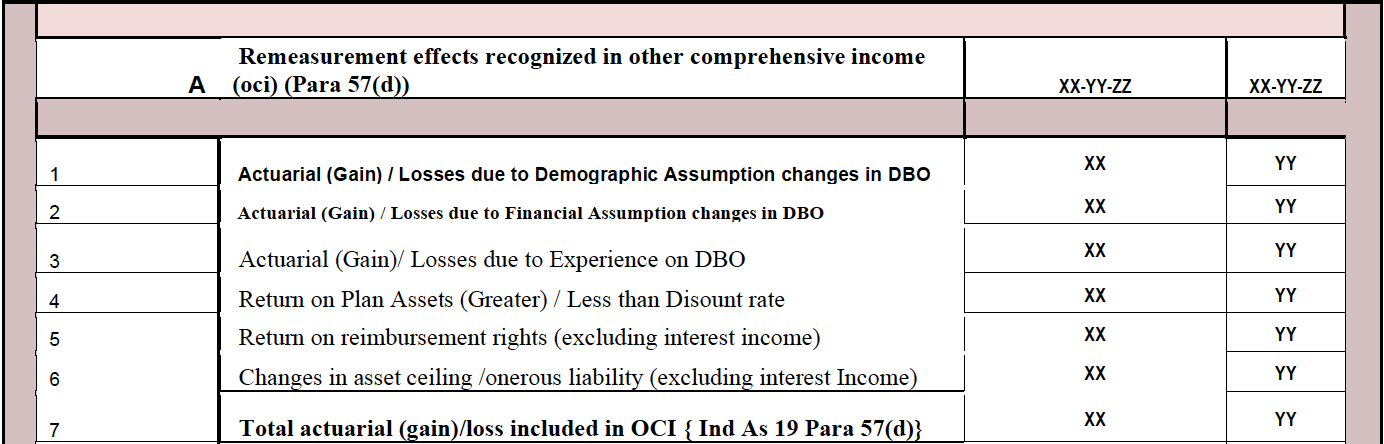

One of the key changes that IND AS 19 standards brings is that in post-employment benefit plans such as gratuity and pensions, actuarial gains and losses will now flow through OCI without impacting the profit and loss statement. The concept of OCI did not exist in AS-15(R) however is now brought into IND AS 19. OCI stands for Other Comprehensive Income.

Actuarial gains and losses is now split into 3 components – Gain/loss due to change in financial assumptions, gain/loss due to change in demographics assumptions and gain/loss due to change in experience.

Figure: Remeasurement effect in OCI / IndAS 19

Figure: Remeasurement effect in OCI / IndAS 19

It is to be noted however, that for other long term employment benefits such as long term service awards, actuarial gains and losses continue to flow through the profit and loss statements, even in IND AS 19. As opposed to AS 15 R, where the gain/loss directly impacted your Profit and Loss, in case of IND AS 19, all actuarial gains/losses will flow through Other Comprehensive Income tables.Thus the impact of actuarial gains and losses is accounted separately, ensuring minimal volatility in the Profit and Loss Account due to change in actuarial assumptions..

Net Interest on the Defined Benefit Liability

IND AS 19 now requires disclosure of the net interest on the defined benefit liability. The net interest on defined benefit liability includes Interest income on plan assets (which is a factor of the discount rate along with the fair value of the plan assets) and interest cost of the defined benefits obligation. Under AS 15(R), expected return was calculated using a separate assumption, however now it is linked to the discount rate.

Discount Rate

As per IND AS 19, it is now mandated to use discounting rate with reference to market yields at the end of reporting period on government bonds.

Additional disclosures under IND AS 19:

Sensitivity analysis of the obligations based on changes in one assumption (Discount rate +/- 1% or Salary Escalation +/- 1% or Attrition Rate +/- 0.5%, etc) while keeping the other factors unchanged.

IND AS 19 also requires estimation and disclosure of the expense for the next financial year and the expected future cash-flows for the next 10 years.

IND AS 19 also mandates presentation of the expected cash flow for the next five years for each year and then for years 6-10 in a consolidated approach. We has to show the effective period of the future liability and also the annual contributions. It has to show accrued benefits, projected benefits and vested benefits.

Related Topics:

View Model Reports for Ind AS 19 and AS 15(R) standards

5 Key Differences Between Ind AS 19 and AS 15(R)

Balance Sheet and P&L Accounting Under IndAS 19 With Examples

© Copyright 2020. All Rights Reserved Home | Contact Us | Knowledge Base | Privacy | Terms of Use